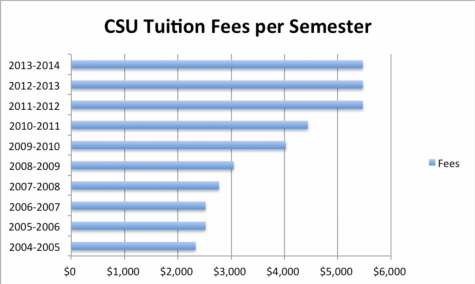

Cost of Attending CSU Up 1,360% Over Last 40 Years

If the average price of a new car in 1979 had increased at the same rate of inflation as the cost of tuition at California State University, it would now cost $93,435 to drive that car off the dealer’s lot.

If the average price of a new car in 1979 had increased at the same rate of inflation as the cost of tuition at California State University, it would now cost $93,435 to drive that car off the dealer’s lot.

And fueling would drain your bank account, because gas that cost on average 88 cents a gallon in 1979 would now cost almost $12 per gallon if gas prices kept pace with college fees.

That’s because, according to California Budget and Policy Center, from 1979-2019 the cost of tuition increased 1,360 percent. In 1979 the average cost of tuition was $500, compared to today’s average of $7,300.

Budget cuts over the last 40 years have led to the increase in tuition, food and housing on campus.

Off-campus housing costs have also far outpaced inflation over that time. Incomes for lower and middle class families haven’t kept up with the increase in housing cost leaving half of California renters barely being able to afford housing.

The college students before this generation, were able to work moderate hours and attend school full-time. Students were graduating on time and with little to no debt. Today’s students face a much different situation.

To make up for lost revenue, colleges have increased the pricing for housing, tuition, food and books, making it difficult for low-and-middle income students to afford college.

Financial aid systems help the students afford college, but according to debt.org on a poll from 2017, on average college students graduate with about $37,000 in debt.

Lawmakers are proposing a number of options to help with the California student homelessness, and the rising on the student debt crisis. They do this by building a rainy- day fund so a economic downfall in the future doesn’t financially destroy California college students.