Is a $4 increase in your wage worth quitting that retail job for a position at McDonald’s? Students at Rio just aren’t sure. In March, California law raised the minimum wage for fast food workers to a whopping $20 an hour.

Obviously, as with everything, there are plenty of pros and cons for this wage raise. For one, fast food is a notoriously difficult industry to be a part of, and employees deserve to be paid enough to make a living no matter what they do for work. Working in fast food often involves working hours late into the night and dealing with a constant stream of orders. Additionally, the popularity of services like Doordash and UberEats post-Covid just adds to the workload. Higher wages would not only draw more people to the profession, but compensate them fairly in regards to the work they do.

On the other hand, restaurants will have to start raising food prices to accommodate for higher wages, which greatly affects consumers and in turn creates a positive feedback loop. Fast food has been a reliably cheap meal option, which in this economy is rare. However, this might not be true for long, as prices could be rising to as much as 8% in some cases.

Inevitably, the ever-changing economic climate is responsible for this change. Due to inflation, $16 an hour is no longer sustainable for a lot of people to live comfortably in California.

Senior Gianna Ackerman works in food service, but she hasn’t experienced a wage raise as she doesn’t work in fast food. She believes the wage raise is fair, but wishes it would apply to other minimum wage workers such as herself.

“A lot of people don’t have the time or means to work anywhere else but entry level jobs such as fast food restaurants, and that doesn’t mean they should be struggling to live paycheck to paycheck,” Ackerman said.

This particular raise in wages targets fast food employees, but that doesn’t mean other occupations won’t receive the same benefits. After all, inflation affects everyone who participates in the economy.

“I think that the wage raise should be applied to all minimum wage workers, to account for the inflation, and not just fast food workers,” Ackerman said.

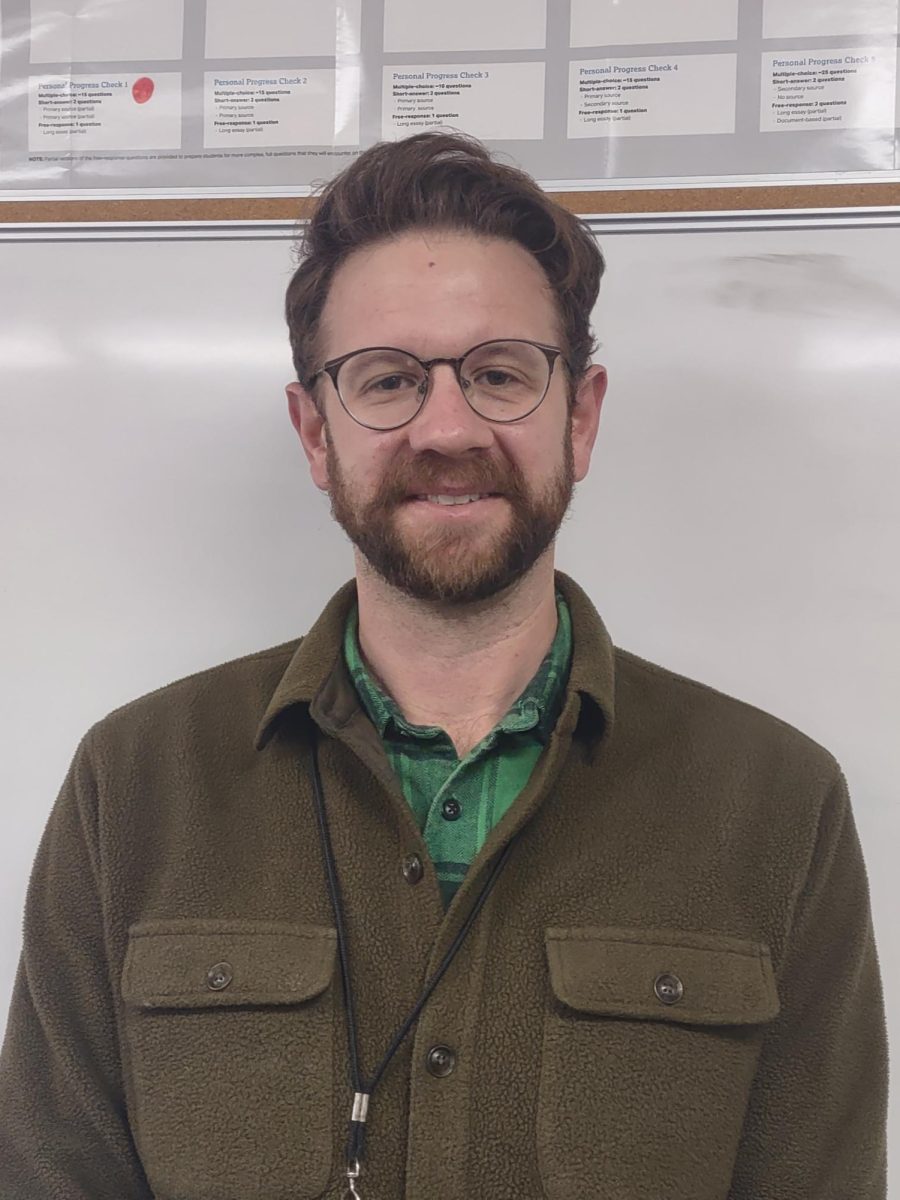

Senior Grant Shepard is an employee at McDonald’s and has recently experienced a bump in his wage. However, he has some critiques.

“For the wage raise, I personally enjoy it but I also realize what needs to happen for our wages to go up. Food prices drastically increase, hours get cut, people get laid off,” Shepard said. “So in that regard I don’t like the new wage increase.”

The higher salary also doesn’t give Shepard incentive to stay in fast food, as he values the environment and culture surrounding the workplace more.

“The wage isn’t really making me stay at my job. I prioritize work environment and flexibility over a couple more dollars of pay and I would leave if a better opportunity came up for me,” Shepard said.

What’s important is that corporations such as McDonald’s aren’t cutting costs while paying workers more money. Although it’s necessary to meet the financial needs of employees, customers are also integral to the success of these companies. Additionally, companies will have to raise prices to match the higher wages.

Senior Emi Davis-Perez believes this wage raise is bittersweet, as employees benefit but customers don’t.

“It’s good for workers but it will raise prices on fast food, making it harder for the people working there to even afford to eat there,” Davis-Perez said.

If this pattern continues, food prices will continue to increase, even the food that’s supposed to be affordable.

“This wage raise is an example of shrinkflation,” Davis-Perez said.

Shrinkflation is a phenomenon used in economics to describe the quality of a product decreasing (hence the “shrinking”) while prices increase. In this case, the quality of fast food will decrease due to money being spent on production redirected towards paying the wages of employees.

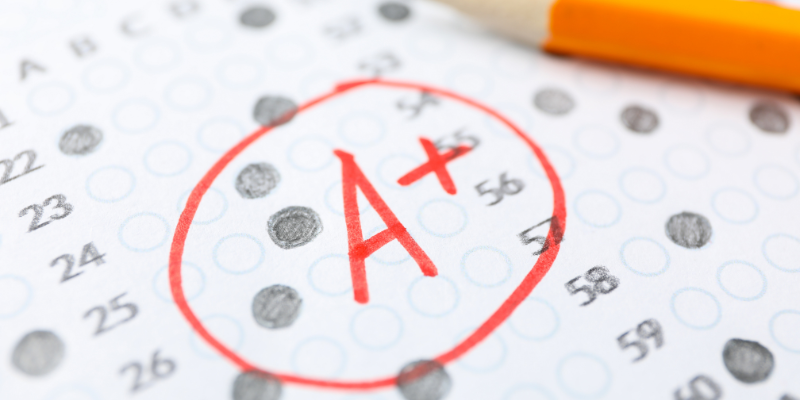

Regardless of the upsides and downsides of this pay increase, it’s a good lesson on economics, especially for Rio students working in the fast food industry. It also gives us a glimpse on how inflation will be affecting our generation as we move into the workforce and start becoming financially independent in the coming years.